Life, you know, has its moments, doesn't it? Sometimes, a little unexpected something pops up, and suddenly you're thinking about how to handle it. Well, if you've ever found yourself needing a bit of financial breathing room, a way to get funds when you really need them, then a line of credit could be something worth looking into. It's almost like having a financial safety net that you can draw from, just a little, when things come up.

This kind of financial tool is, in a way, about having choices. It means you can get money when you need it, rather than having to wait around. The idea is to make getting access to funds straightforward and easy to use, so you can focus on what matters most.

We're going to explore what a service like credit fresh offers, how it works, and what it might mean for you. We'll look at the good parts, some things to keep in mind, and what it might cost. Basically, we want to help you figure out if this kind of help fits what you're looking for.

Table of Contents

- Understanding Credit Fresh - What is it Really?

- How Does Credit Fresh Work for You?

- Who Can Use Credit Fresh?

- What Are the Benefits of Credit Fresh?

- Things to Consider with Credit Fresh

- Getting Started with Credit Fresh

- Reaching Out to Credit Fresh

- Making Sense of the Cost of Credit Fresh

Understanding Credit Fresh - What is it Really?

So, what exactly does credit fresh put on the table for people? Well, they have this kind of credit that's pretty flexible, and it's also meant to be clear about what you're getting into. You see, they offer amounts that can go from a smaller sum, like five hundred dollars, all the way up to five thousand dollars. This range, you know, gives people a fair bit of room to work with, depending on what they might need.

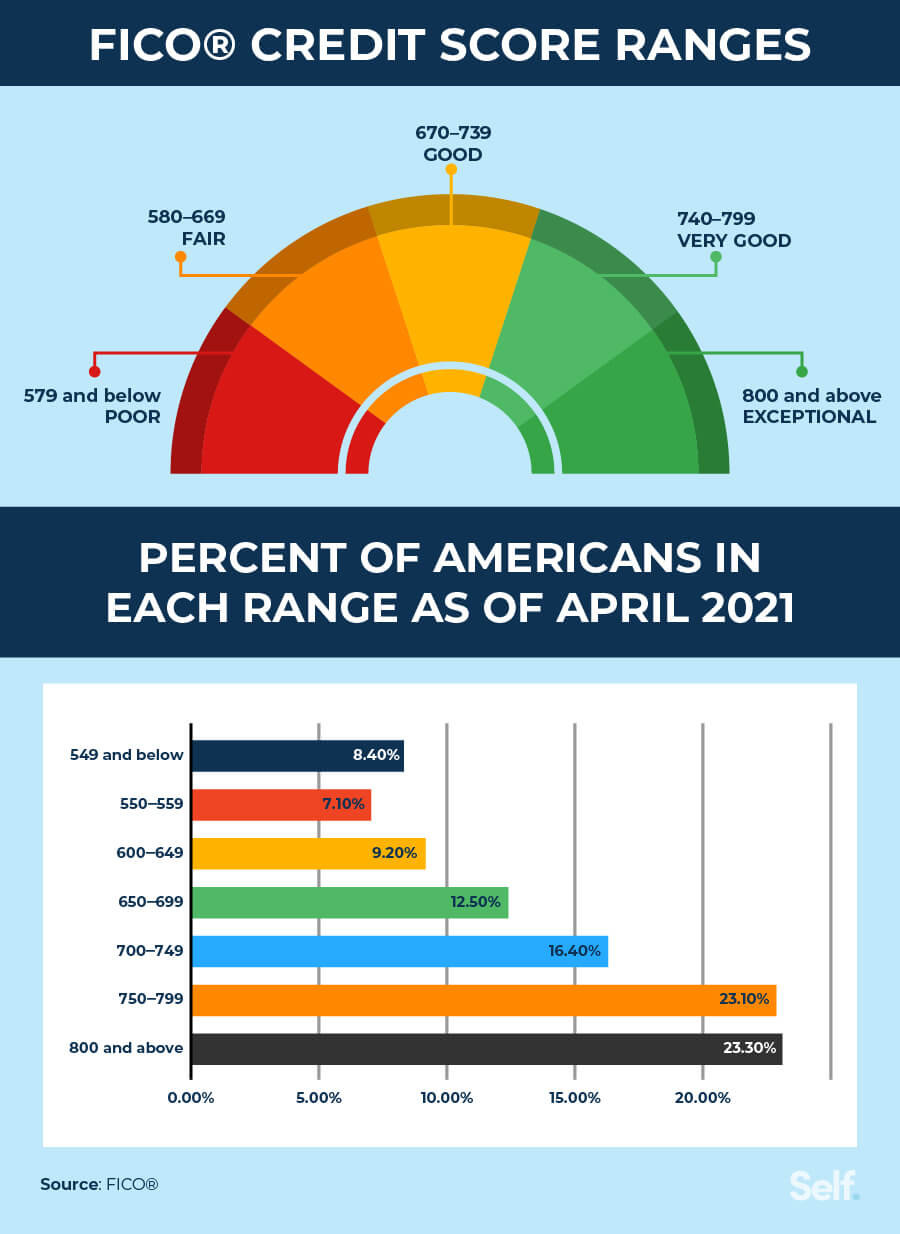

What's really interesting, and quite helpful for many, is who they tend to work with. It's not just for those who have a perfect financial history. Actually, they're set up to help folks whose past credit experiences might be, shall we say, a bit less than ideal. This includes people with what's often called "fair" credit, and even those who might have what's considered "poor" credit. So, in some respects, it opens up possibilities for a wider group of people who might otherwise struggle to find options.

A line of credit, as offered by credit fresh, is a bit different from a regular loan. With a regular loan, you get a lump sum all at once. But with a line of credit, it's more like a pool of money you can draw from as you need it. You only pay for what you actually use, which is a pretty neat feature for unexpected costs. This means you have access to funds without having to take out a whole new loan every time something comes up, which is very convenient.

Credit fresh describes their service as a personal line of credit. This means it's for individual use, for things like covering sudden bills or other expenses that pop up without warning. It's what people call unsecured, meaning you don't have to put up your house or car as a guarantee. This can make it feel less risky for some people, too. It's about getting quick and accessible money when you might not have other ways to get it, or when you prefer a more flexible option.

How Does Credit Fresh Work for You?

The way you get started with credit fresh is meant to be simple and easy to do. It’s not about filling out stacks of paperwork or waiting for days on end. The whole idea is to make the process as smooth as possible, so you can focus on what you need the money for. You can apply for this kind of help online, which is quite handy for most people these days.

Once you apply and get the green light, meaning you're approved, you then have the ability to ask for money whenever you need it. This is the revolving part of a line of credit, you know. As long as you have credit available in your account, you can request a draw. It's pretty straightforward: you ask for what you need, and it gets sent to you. There's no set minimum payment amount that you have to send in, and they mention a fixed fee structure, which we'll talk about more later. This setup, basically, gives you a lot of control over how and when you use the funds.

With credit fresh, they say there's no impact on your credit score just for applying. This is something many people worry about, so it's a point worth noting. The application process itself is designed to be quick, and they aim for fast funding. This means that if you get approved, the money could be in your hands relatively quickly, which is often what people need when an unexpected expense comes along.

Another aspect of how credit fresh operates is that there's no specific final payoff date for your balance. This is different from a traditional loan where you have a set end date. And, interestingly, they say there are no penalties if you decide to pay back more than what's expected, or even pay it off early. This can give you a lot of freedom to manage your payments in a way that suits your own financial situation, which is really quite good.

Who Can Use Credit Fresh?

When it comes to who can get help from credit fresh, it's pretty clear they are looking to serve a specific group of people. They offer personal lines of credit for folks who might have what's called "poor" credit or even no credit history at all. This is a big deal because many traditional lenders often shy away from people in these situations, leaving them with very few choices. So, this service is, in a way, filling a gap for those who need it most.

They mention that their lines of credit range from five hundred dollars up to five thousand dollars. This range is pretty standard for personal lines of credit, and it's generally aimed at covering those unexpected bills or expenses that just pop up. It's not meant for buying a house or a car, but more for those smaller, immediate financial needs. So, if you're facing a sudden car repair or a medical bill, this kind of service might be something you consider.

What Are the Benefits of Credit Fresh?

One of the big upsides with credit fresh is the flexibility it offers. You get a line of credit, which means you have access to a certain amount of money, but you don't have to take it all at once. You can draw from it as you need it, which is pretty useful. It's like having a financial cushion that's there for you, but you only tap into it when you actually have to. This can save you money because you only pay charges on the money you actually borrow, not the whole amount you're approved for.

The convenience factor is also a big plus. Once you're approved, you can ask for a draw online anytime you need it, as long as you have available credit. This means you don't have to go through a lengthy process every single time you need a bit of money. It’s quite simple, really, and it means you can get funds pretty quickly when time is of the essence.

They also talk about being transparent with costs. No one likes hidden fees or confusing terms, do they? With a line of credit through credit fresh, they say you can expect a clear experience. They even suggest using a payment calculator to help you figure out what things might cost. This is a good sign, as it helps you understand your financial commitments upfront, which is very important for peace of mind.

Another point they bring up is that applying for a line of credit through credit fresh is secure and fast. This is something people really value when dealing with their personal financial details online. And if you get approved, you can access the money anytime, as long as you have credit available. It's about giving you quick access to funds when you need them most, which is, you know, what this kind of service is all about.

Things to Consider with Credit Fresh

While there are some good things about credit fresh, it's also important to look at the other side of the coin. Some reports mention that their fee structure can be a bit vague and potentially expensive. This is something that many customers have apparently voiced concerns about. So, it's a good idea to really dig into the details of the fees and costs before you commit, just to make sure you're comfortable with what you're getting into.

You see, some online lending marketplaces, including credit fresh, are described as having high interest rates and billing cycle fees. This is something that can add up over time, especially if you carry a balance for a while. So, while the flexibility is nice, the cost of that flexibility can be something to watch out for. It's always a good idea to compare different options and really understand the full cost of borrowing.

It's also worth remembering that not all requests for funds are approved. While the process might be simple, approval still depends on certain criteria. You need to have available credit, your account needs to be in good standing, and you must meet any other requirements to request money from your account. This is standard for any financial service, of course, but it's something to keep in mind so you don't assume approval is guaranteed every time you ask for a draw.

Getting Started with Credit Fresh

If you're thinking about applying for a line of credit with credit fresh, the process is designed to be pretty simple. You submit your request for this online loan, which is in the form of a line of credit. It's quick and straightforward, which is what most people are looking for when they need funds in a pinch.

Once you get approved, you then have access to your available credit whenever you might need it. This is, you know, as long as your account stays in good standing. This means you can get the money you need, up to your credit limit, whenever an unexpected expense pops up. It's about having that immediate access without a lot of fuss.

For people in Texas, specifically, credit fresh mentions that you may be able to qualify for an online loan between five hundred dollars and five thousand dollars. So, if you're in that area and looking for a smaller personal loan, this could be an option to consider. It really highlights how accessible they aim to be for a range of people looking for financial help.

Reaching Out to Credit Fresh

Sometimes, you just need to talk to someone, don't you? If you have questions about credit fresh or their services, they make it pretty easy to get in touch. You can send them an email, give them a call, send a text, or even mail them something. The good news is they are available seven days a week, which is quite helpful for people who might have questions outside of regular business hours.

They also mention that you'll have access to a secure online account. This is where you can look over your line of credit agreement and other important terms related to your account. Having everything in one place, where you can check it securely, is a nice touch. And, apparently, they have a really good customer service team available to help you out, which is something many people value when dealing with financial matters.

It's also worth noting that credit fresh is mentioned in relation to credit and debt counseling services in Piscataway, New Jersey. This suggests a broader involvement in helping people with their financial health, beyond just offering credit. They also come up in discussions about energy debt forgiveness programs for customers in New Jersey, overseen by the New Jersey Board of Public Utilities. This paints a picture of a company that is, in some ways, connected to helping people manage their finances in different situations.

Making Sense of the Cost of Credit Fresh

When you're looking at any financial product, really, understanding the cost is super important. With credit fresh, they say they aim for a clear repayment structure and no hidden fees. This is something they want you to know upfront. They even suggest using a payment calculator to help you see what your payments might look like, which is pretty helpful for planning your budget. It's about making sure you know what you're getting into, you know?

The key idea with a line of credit through credit fresh is that you only pay charges on the money you actually borrow. This is a big difference from some other types of loans where you might pay interest on the whole amount, even if you don't use it all. So, if you're approved for five thousand dollars but only take out one thousand, you're only paying for that one thousand. This can potentially save you money if you don't need the full amount right away.

They also emphasize that submitting a request for this online loan is quick and simple. And if you're approved, you get access to your available credit whenever you need it, as long as your account is in good standing. This flexibility in accessing funds, combined with the promise of clear costs, is a big part of what credit fresh offers to people looking for financial breathing room.

So, we've talked about what credit fresh is, how it works, who it might be for, and some of the things to think about when considering their services. We looked at the idea of a flexible line of credit, the simple application process, and how you can get money when you need it. We also touched on the range of credit they offer, from smaller amounts to larger ones, and how they work with people who might have less-than-perfect credit histories. We also went over the importance of understanding the fees and how to reach out to them if you have questions.