Ever wondered how some folks seem to have a special edge when it comes to figuring out what's happening in the markets? It's not always about having secret connections or a crystal ball, but rather, more often than not, it involves getting a good look at information that isn't always easy to find. This kind of insight, you know, can really make a difference for everyday people who want to feel more confident about their money choices.

For a long time, tapping into really big piles of market information felt like something only giant investment firms or those with very deep pockets could do. They had all the fancy tools and teams to sort through mountains of numbers and figures. But what if there was a way for regular individuals, people like you and me, to get a similar kind of view, to actually use the vast amount of public data out there to help shape their own ideas about investing? It seems like a pretty useful thing to consider, doesn't it?

That's where something like Quiver Quant comes into the picture, offering a way for more people to connect with important market signals. It’s a platform that aims to put the kind of powerful data typically reserved for big players right into the hands of individual investors. In a way, it helps level the playing field a bit, giving everyone a chance to look at information that could help them build and test their own unique approaches to the market. So, let's explore what this platform is all about and how it works.

Table of Contents

- What is Quiver Quant, Anyway?

- Why Should Regular Folks Care About Quiver Quant?

- Can You Really Build Your Own Investment Ideas with Quiver Quant?

- What Insights Can Quiver Quant Offer?

What is Quiver Quant, Anyway?

So, you might be asking, "What exactly is this Quiver Quant thing?" Well, at its core, it's a spot on the internet where you can go to do some research about investments. Think of it as a helpful assistant that goes out onto the web, gathers all sorts of unusual information, and then brings it all back together in one simple, free spot for you to check out. It's almost like having a personal detective for market data, just a little less dramatic, of course. This kind of information isn't always the usual stuff you find in financial news, which is part of what makes it so interesting.

How Does Quiver Quant Get Its Information?

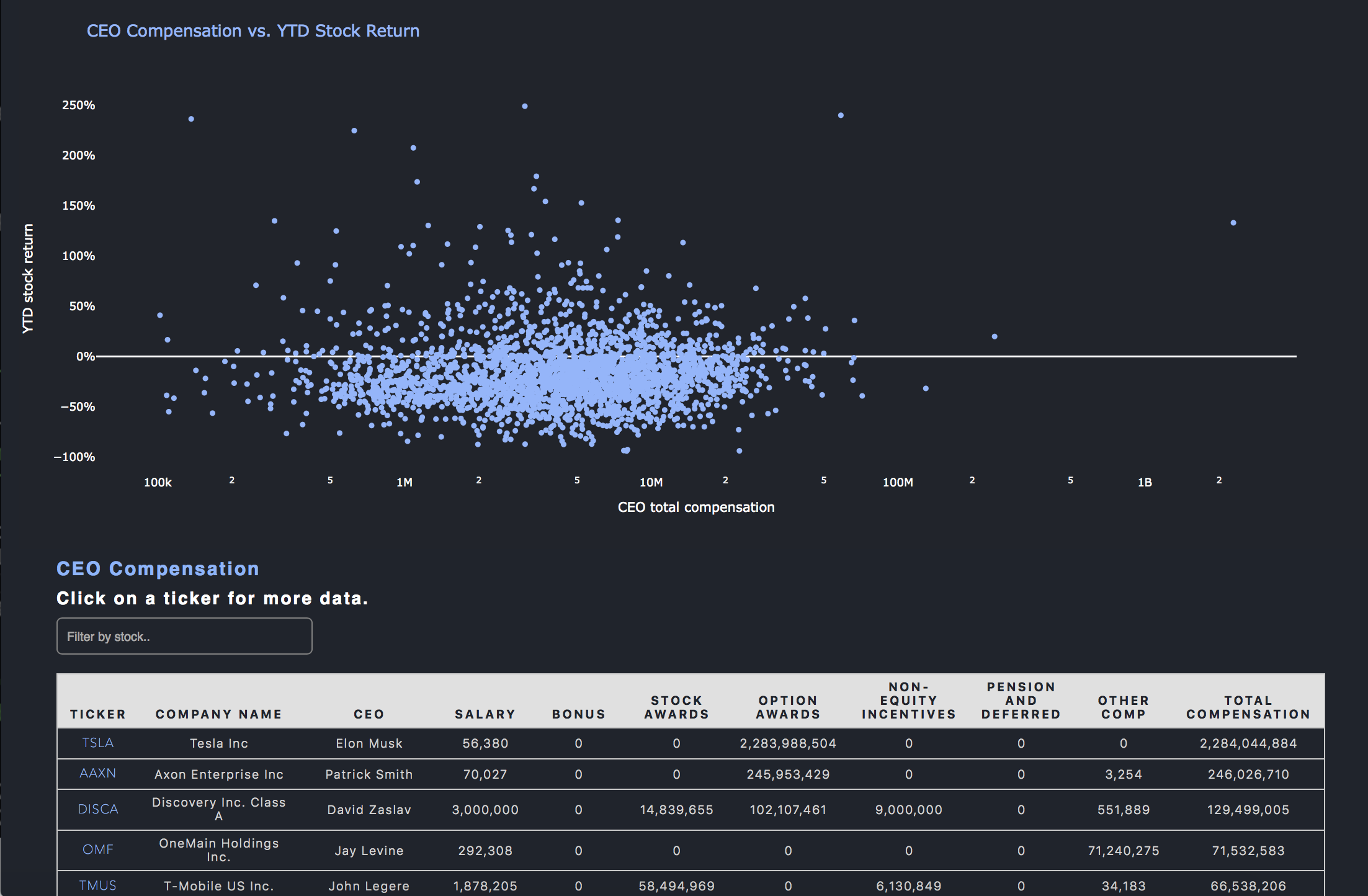

When we talk about how Quiver Quant gathers its information, it’s really about pulling together what's called "alternative data." This means it collects facts and figures from all over the internet, things that aren't your typical company earnings reports or stock prices. It could be anything from public records to other digital footprints. The goal is to collect this wide range of data and then put it all together in a way that's easy for anyone to use. It's a bit like taking a bunch of scattered puzzle pieces and assembling them into a clear picture, which is pretty neat if you think about it.

Why Should Regular Folks Care About Quiver Quant?

For a long time, the idea of using "big data" for investment decisions felt like something only Wall Street pros could do. But Quiver Quant changes that quite a bit. It gives everyday people the chance to use these large collections of facts and figures to help them make their own financial choices. It's about giving regular investors access to powerful insights that were once out of reach, so they can feel more informed and perhaps even a little more in control of their investment journey. This is, in some respects, a significant shift for individual market participants.

Following the Money - What Quiver Quant Shows You

One of the really interesting things Quiver Quant does is let you see what members of the U.S. government are doing with their own money in the stock market. You can look at their recent trades, search for a particular politician or a specific stock, and even find out which members of the Senate and House of Representatives are buying and selling the most. This kind of information, you know, can sometimes offer a different perspective on market activity, which is pretty unique. It provides a window into a part of the market that's not always widely discussed, giving you a somewhat different angle to consider.

Being able to check out these details means you get a peek at financial movements from a somewhat unexpected source. You can, for instance, see if certain stocks are being bought or sold by those in positions of power, which might just spark a new thought or two for your own research. It's not about copying anyone, but rather about having more pieces of the puzzle available. This feature, arguably, adds a distinct layer of transparency that wasn't always so readily available to the public. It really helps make a lot of this information more accessible.

The platform also lets you keep an eye on how well different investment approaches, those that use this "alternative data," are actually performing. You can see what assets they hold and how they've done over time. This means you're not just getting the raw information, but also a sense of how these less traditional methods of looking at the market are playing out in the real world. It's a way to learn from what others are trying, which can be very helpful for anyone looking to broaden their own investment horizons. This is, in a way, a practical application of data science for the everyday investor.

Can You Really Build Your Own Investment Ideas with Quiver Quant?

Absolutely, you can! Quiver Quant is set up so you can develop and test your own unique investment strategies. It gives you access to special collections of data, like information on what big institutions own. This means you can try out your theories and see how they might have performed using real historical data. It's a bit like having a sandbox where you can play around with different ideas without any real risk, which is pretty cool for anyone who likes to experiment. You can really get a feel for what works and what doesn't before putting your own money on the line.

The ability to construct and then put your own plans to the test, using actual figures from the past, is a big advantage. You're not just reading about what others are doing; you're actively trying out your own thoughts. This hands-on approach can really help you learn and grow as an investor, giving you a deeper grasp of how markets react to different factors. It’s almost like having a practice field for your financial ideas, and that, you know, can build a lot of confidence over time.

Exploring Different Strategies with Quiver Quant's Tools

When you're exploring different ways to approach the market, having the right tools makes a huge difference. Quiver Quant provides datasets that include what large, established organizations hold in their portfolios. This kind of data is usually quite hard for individual investors to get their hands on, but it offers a lot of insight into where the big money is moving. By looking at these institutional holdings, you can get a better sense of broader trends and perhaps even spot opportunities that you might have otherwise missed. It's a very practical way to see what the major players are doing.

Being able to use these specific datasets to build and test your own methods means you're working with information that truly reflects significant market activity. It allows you to refine your approach based on what has actually happened in the past, rather than just guessing. This process of testing your ideas against real-world data is, frankly, invaluable for anyone serious about making more informed investment decisions. It’s about being proactive and thoughtful in your approach, which is something many people are looking for.

What Insights Can Quiver Quant Offer?

Beyond just showing you data, Quiver Quant can help shed light on some of the less obvious happenings in the market. By pulling together all this alternative information, the platform can sometimes reveal patterns or trends that aren't immediately apparent through traditional news sources. It’s about looking at the bigger picture from a different angle, giving you a chance to spot things before they become widely known. This kind of foresight, you know, can be quite a powerful thing for investors.

The platform's ability to gather and present these varied data points means it can offer insights into areas that are often overlooked. It's not just about what's reported in the headlines; it's about the underlying currents that can influence market movements. This broader perspective allows users to develop a more nuanced view of the financial landscape, which is really quite valuable. It helps you connect dots that might otherwise remain separate, providing a fuller picture of what's going on.

Uncovering Market Trends with Quiver Quant's Leadership

It's interesting to note that the person in charge of Quiver Quant, their CEO, has spoken about uncovering market trends that are often hidden from public view, especially those connected to Washington D.C. This suggests that the platform isn't just a collection of numbers, but also has a leadership team that understands how to interpret these unique data points. It’s about connecting the dots between public information and potential market movements, which can be quite insightful for users. This kind of expert perspective adds another layer of value to what Quiver Quant provides, offering a deeper understanding of what the data might be telling us.

The idea that there are market trends influenced by political activity, which are not always visible to the average person, is a significant point. Quiver Quant aims to make these less obvious connections more apparent through the data it collects. So, it's not just about seeing who bought what stock, but also about understanding the broader influences that might be at play. This focus on revealing "hidden" patterns is, frankly, a key part of what makes the platform so compelling for those interested in a more complete market picture. It's about getting a peek behind the curtain, in a way, to see what's really happening.