So, you know, getting your credit score where you want it can feel like a really big project, right? For many people, the idea of sorting out credit reports and dealing with financial agencies just seems too much to handle. This feeling of being stuck, perhaps with old money problems holding you back, is a very common one. It can make things like getting a home loan or even just a decent car payment seem out of reach, which is a real bummer.

This is where a helpful tool like `Dispute Beast` steps in, offering a way to tackle those pesky credit report issues without needing a law degree or a ton of cash. It’s a pretty clever system, actually, that helps you take charge of your own financial picture. Think of it as having a friendly guide to show you the ropes, making what seems like a difficult task much more approachable. It’s all about putting the power back into your hands, letting you work on improving your credit standing at your own pace, which is pretty neat.

It helps you look at what’s on your credit report and figure out what might be causing trouble. Then, it helps you put together the right kind of messages to send off, asking for corrections. This means less guessing for you and more direct action. The whole idea is to give you a straightforward path to getting things sorted, moving you closer to better financial health with a bit of support along the way, you know?

Table of Contents

- What's the deal with Dispute Beast and your credit?

- How does Dispute Beast help you fix things?

- Getting Started with Dispute Beast

- The Dispute Beast Way - Attacking from All Sides

- What about the cost for Dispute Beast letter creation?

- How Dispute Beast makes credit repair easy

- Is Dispute Beast for everyone?

- Connecting with Dispute Beast as a Helper

What's the deal with Dispute Beast and your credit?

So, what exactly is `Dispute Beast`? Well, it’s a helpful application that lets you take care of your own credit concerns. It uses a bit of clever computer logic to help you get your credit score in a better spot. Think of it as your own personal helper for dealing with credit report issues, letting you handle things yourself. It’s pretty much built to make the process of getting things right on your report a whole lot simpler, which is good, because credit stuff can be a bit confusing sometimes, you know?

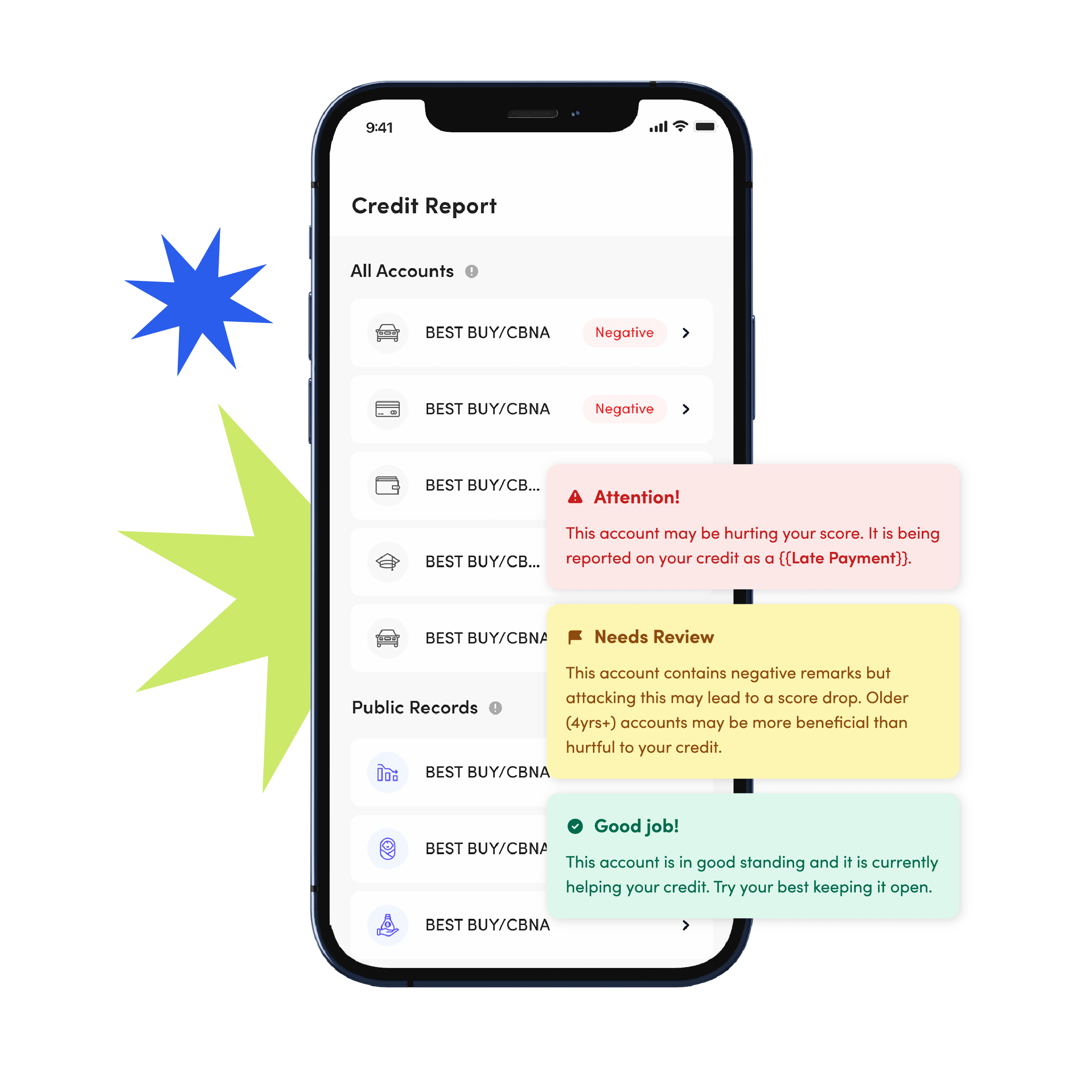

This little assistant takes a close look at your credit report. It’s really good at spotting any new problems that might have shown up, like things that could be pulling your score down. Once it finds these new negative items, it helps you go after them. It’s like having a watchful eye on your financial records, ready to point out where you might need to take action. This way, you’re not left guessing about what to do next, which is very helpful.

You might be wondering, though, how long it actually takes to see your credit score get better with something like `Dispute Beast`. That’s a fair question, and it’s something a lot of people think about. The truth is, results can vary a bit for everyone, as a matter of fact. It depends on what’s on your report and how quickly things get processed. But the idea is to give you a steady way to work on things, rather than just hoping for the best.

How does Dispute Beast help you fix things?

The main way `Dispute Beast` helps you is by assisting you in challenging those negative items that show up on your credit reports. These could be old bills you thought were paid, or perhaps things that just aren't quite right. The platform gives you the tools to put together official messages to send to the people who handle credit information, asking them to look into these items. It's about getting those errors or unfair listings off your record, which can really help your score climb up, you know?

One pretty cool thing about `Dispute Beast` is that it offers you a chance to get a free look at your credit situation. This means you can get a good idea of what’s going on with your score and what might need attention without spending any money upfront. It’s a bit like getting a free check-up for your financial health. This initial step can be really helpful for figuring out where to start, especially if you’re not quite sure what’s causing your credit troubles, which is pretty common.

The whole process is made easier because `Dispute Beast` uses some clever computer programming to help you tackle items on your credit report. It simplifies what could be a very complicated task, letting you get straight to the point of challenging what you believe is incorrect. So, if you’re looking to get a better handle on your credit and start making improvements, it really does make the process more approachable. It’s about giving you the means to take better control of your own financial standing, which is something many people want, actually.

Getting Started with Dispute Beast

Getting going with `Dispute Beast` is pretty straightforward, which is good. You just create your account, which doesn't take long at all. Then, you connect your credit monitoring service, so the system can see what's on your reports. After that, you can start going after those negative items that are causing trouble. The final step is sending out the dispute letters, and the whole thing can be done in just a few minutes. It’s really designed to be quick and simple to get you started on the path to a better credit picture, you know?

This tool is considered a leading option for do-it-yourself credit fixing, and it’s all thanks to its clever computer brains. It’s built to make the process of improving your credit simpler and to help you get real outcomes with just a few clicks. You don't need to be an expert to use it, which is a big plus. It handles a lot of the fiddly bits for you, so you can focus on getting your credit where you want it to be. It’s a bit like having a helpful guide that walks you through each step, making sure you don't miss anything important.

Making your dispute letters with the `Dispute Beast` system is something you can do without paying a cent. That’s right, the letter-making part is free, which is a pretty good deal. However, to actually use this feature and send out those letters, you do need to have an active subscription to their credit monitoring service, called Beast monitoring. This service helps keep an eye on your credit information, so the system knows what to put in the letters. If you have that monitoring in place, you can create as many letters as you need, which is very handy for working through all your issues.

The Dispute Beast Way - Attacking from All Sides

One of the really unique things about `Dispute Beast` is how it handles challenging items. It doesn't just send messages to the big credit reporting companies; it also goes directly to the data furnishers. These are the businesses or people who originally reported the information, like a bank or a store. This ability to go straight to the source is not something you typically find with other credit fixing tools or services. It means you’re tackling the problem from all angles, which can be much more effective, you know?

The system uses its special computer program, called BeastAI, which has processed a huge number of letters – close to a million, actually – to challenge incorrect items on people’s accounts. This experience means it knows how to put together powerful, personalized challenges. With just one click, `Dispute Beast` creates these strong messages that question incorrect or unfair accounts on all three important levels: the credit reporting companies and the data furnishers. This multi-pronged approach gives you a really thorough way to clear up any mistakes on your credit report, which is quite effective.

This way of going after things on all three levels means `Dispute Beast` gives you a really complete plan for getting rid of any mistakes on your credit report. It’s not just hitting one spot; it’s covering all the bases. The key is to stick with it and keep sending those challenges regularly. If you do that, you’ll start to see your credit picture get clearer over time. It’s a consistent effort that pays off, sort of like chipping away at a big project little by little, you know?

What about the cost for Dispute Beast letter creation?

So, we talked about the letters being free to make, but what about the full picture? `Dispute Beast` does have a monthly cost for its credit monitoring service, which is about $49.99 each month. This monitoring is what allows you to use the letter-making tool and get all the other benefits. It also provides you with different ways to approach fixing your credit. This fee covers the ongoing watch over your credit information and the ability to keep generating those important challenge letters. It's pretty much a package deal for getting your credit in order, which is something to consider.

How Dispute Beast makes credit repair easy

The whole point of `Dispute Beast` is to make fixing your own credit something you can actually do. It’s a powerful piece of software that helps you challenge items on your credit reports that are either wrong or causing trouble. Instead of having to figure out what to say or how to format things, the system helps you put it all together. This means you can work on getting those inaccurate items removed without needing to hire someone else or spend hours researching, which is a big relief for many people.

One of the nice things about `Dispute Beast` is how it takes away the chore of endless paperwork. You know, all those forms and letters you might have to fill out by hand? This system helps you avoid all that. It’s designed to simplify the process of creating and sending out your challenges. This means less time spent on tedious tasks and more time seeing results. It’s a bit like having a helpful assistant handle the boring stuff so you can focus on the bigger picture of improving your financial standing, which is pretty cool.

If you’re serious about getting the most out of your credit fixing efforts in a way that’s both effective and doesn’t break the bank, `Dispute Beast` could be a really good option. It’s considered a very helpful tool for those who want to take control of their credit situation. To really get a full grasp of how it works and how to use it best, it’s a good idea to read through their frequently asked questions section. That part has a lot of useful information that can help you understand all the ins and outs, you know?

Is Dispute Beast for everyone?

In today's financial climate, many folks are looking for ways to get their credit scores into better shape. A popular tool that has come along to help with this is `Dispute Beast`. It’s built for individuals who want to take a hands-on approach to their credit. If you’re someone who prefers to handle things yourself, rather than relying on others, this system might be a good fit. It gives you the means to work on your credit issues directly, which is a pretty empowering feeling for a lot of people, actually.

The system is set up to help you send out challenges to the credit reporting companies about every 40 days. This regular schedule helps keep the process moving along, which is important for seeing changes. Beyond just sending the messages, `Dispute Beast` also helps you figure out what the responses mean, how to keep following up, and how to make your efforts even better over time. It’s about giving you a complete picture, from sending the first message to understanding the final outcome, so you’re never left in the dark, you know?

There’s even a place where you can find answers to common questions about `Dispute Beast`. It’s like a big collection of helpful tips and tricks to help you get really good at fixing your credit. This section can help you uncover all sorts of useful information to become a real pro at handling your credit repair tasks. It’s a very helpful resource for anyone who wants to make sure they’re using the system to its full potential, which is something many users appreciate.

Connecting with Dispute Beast as a Helper

For those who help others with their credit concerns, there’s a special area called the `Dispute Beast` partner portal. This is where you can keep track of the credit dispute services you offer and help your own clients improve their credit scores effectively. It’s a tool that lets you manage multiple cases and assist people in getting their financial records in better order. This means you can use the system to streamline your work and provide a valuable service to those who need it, which is pretty convenient for professionals.